The smart Trick of Medicare Advantage Agent That Nobody is Discussing

Table of ContentsThe 8-Minute Rule for Medicare Advantage AgentMedicare Advantage Agent for DummiesHow Medicare Advantage Agent can Save You Time, Stress, and Money.The Buzz on Medicare Advantage AgentMedicare Advantage Agent Can Be Fun For AnyoneThe 30-Second Trick For Medicare Advantage Agent

It focuses particularly on those without any kind of health and wellness insurance for any type of size of time. The issues faced by the underinsured are in some respects similar to those encountered by the uninsured, although they are typically much less severe. Uninsurance and underinsurance, nevertheless, involve noticeably various policy problems, and the approaches for addressing them may vary. Throughout this study and the five records to adhere to, the major focus gets on individuals with no medical insurance and therefore no assistance in spending for healthcare beyond what is offered via charity and safety net organizations. Health and wellness insurance is a powerful element influencing receipt of care since both people and physicians reply to the out-of-pocket rate of solutions. Medical insurance, however, is neither needed neither adequate to obtain accessibility to clinical solutions. Nonetheless, the independent and direct effect of health and wellnessinsurance policy coverage on access to wellness solutions is well developed. Others will certainly get the healthcare they need also without medical insurance, by spending for it expense or seeking it from providers that offer care cost-free or at very subsidized prices. For still others, wellness insurance alone does not make certain invoice of care since of other nonfinancial barriers, such as an absence of wellness care service providers in their community, limited accessibility to transportation, illiteracy, or etymological and cultural distinctions. Official research study regarding uninsured populaces in the United States dates to the late 1920s and early 1930s when the Board on the Expense of Healthcare generated a series of records concerning financing physician workplace sees and hospitalizations. This concern ended up being prominent as the numbers of clinically indigent climbed throughout the Great Anxiety. Empirical studies constantly sustain the link between access to care and boosted wellness results(Bindman et al., 1995; Starfield, 1995 ). Having a regular source of care can be taken into consideration a predictor of accessibility, instead than a direct action of it, when health end results are themselves made use of as gain access to indicators. This expansion of the idea of gain access to measurement was made by the IOM Board on Monitoring Access to Personal Healthcare Services(Millman, 1993, p. Whether or not moms and dads are guaranteed appears to influence whether or not their kids receive treatment along with how much careeven if the children themselves have protection(Hanson, 1998). The health and wellness of moms and dads can influence their ability to take care of their kids and the level of family tension. Fretting about their children's accessibility to care is itself a source of tension for moms and dads. Three phases comply with in this record. Phase 2 gives a review of how employment-based wellness insurance policy, public programs and individual insurance policy policies run and interact to give extensive but insufficient coverage of the united state populace. This consists of a review of historic fads and public laws impacting both public and personal insurance coverage, a discussion of the communications among the various types of insurance, and an assessment of why individuals relocate from one program to one more or wind up

The government pays even more than it ought to for these strategies, while the entailed business make a larger profit. This game consists of companies paying physicians to report even more health troubles, sharing the extra money with physicians, and even possessing the physician's workplaces.

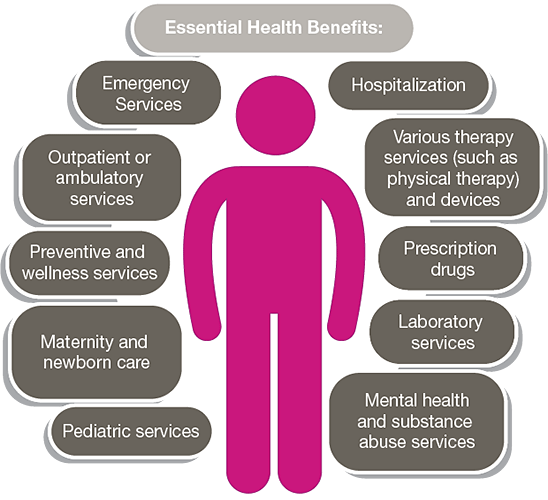

Major health problems can cost lot of times that. Healthcare protection aids you get the treatment you require and safeguards you and your household monetarily if you get ill or harmed. You can obtain it via: Your job or your spouse's task, if the company supplies it. You must meet qualification needs for federal government healthcare programs. For additional information about government programs, see Benefits.gov. Discover more: Medical insurance: 5 things you might not recognize See: Are you instantly needing medical insurance? You can include your family to a work health insurance. If you purchase from an insurance coverage business or the industry, you can buy

Not known Details About Medicare Advantage Agent

a strategy that likewise covers your household. They do not need to live in the house, be signed up in school, or be claimed as a based on Medicare Advantage Agent your tax obligation return. You can maintain wedded kids on your strategy, however you can not add their partners or kids to it. If you have dependent grandchildren, you can maintain them on your strategy up until they turn 25. You can purchase other times just if you lose your coverage or have a life modification. Life changes consist of things like marrying or

separated, having a child, or taking on a kid. You can authorize up for a job health insurance when you're very first worked with or have a significant life change. They can't reject you protection or cost you much more due to the fact that of a preexisting problem or impairment. The expense depends on your conditions. You'll have to pay premiums and component of the cost of your treatment. A costs is a regular monthly cost you pay to have protection. To decide your costs, insurer will certainly consider: Your age. Whether you smoke or utilize cigarette. Whether the coverage is for one person or a household. They might rule out your gender or health and wellness factors, including your medical background or whether you have a disability. Premiums for private strategies are secured in for one year. Rates normally rise when the strategy is renewed to show your age and greater healthcare costs. All health and wellness prepares need you to.

pay several of the price of your health treatment. This is called cost-sharing. In enhancement to premiums, you normally need to satisfy a deductible and pay copayments and coinsurance (Medicare Advantage Agent). A is the quantity you should pay before your strategy will certainly pay. As an example, if your insurance deductible is$ 1,000, your plan won't pay anything until you've paid $1,000 yourself.

Little Known Questions About Medicare Advantage Agent.

The government pays even more than it should for these plans, while the included firms make a bigger revenue. This video game includes business paying medical professionals to report even more wellness troubles, sharing the added money with physicians, and also owning the doctor's workplaces.

Major health problems can set you back lot of times that. Wellness care insurance coverage aids you obtain the care you need and safeguards you and your family members financially if you get ill or wounded. You can get it through: Your job or your partner's job, if the employer provides it. You need to fulfill qualification needs for government health and wellness care programs. To find out more regarding federal government programs, browse through Benefits.gov. Discover more: Medical insurance: 5 things you may not know Watch: Are you all of a sudden needing health and wellness insurance coverage? You can add your family members to a job health insurance plan. If you purchase from an insurance policy business or the market, you can purchase

separated, having a baby, or embracing a kid. You can enroll in a work health plan when you're first hired or have a major life change. They can not reject you insurance coverage or cost you a lot more as a result of a preexisting condition or disability. The price relies on your conditions. You'll need to pay premiums and part of the price of your treatment. A premium is a monthly fee you pay to have coverage. To choose your premium, insurance policy business will take into consideration: Your age. Whether you smoke or use cigarette. Whether the protection is for someone or a family. They might not consider your sex or wellness aspects, including your medical background or whether you have a disability. Costs for private strategies are secured for one year. Rates usually increase when the strategy is restored to reflect your age and greater health and wellness care prices. All health insurance plan need you to.

Unknown Facts About Medicare Advantage Agent

pay several of the cost of your healthcare. This is called cost-sharing. Along with premiums, you typically should fulfill a deductible and pay copayments and coinsurance. A is the amount you must pay before your strategy will certainly pay. As an example, if your deductible is$ 1,000, your plan won't pay anything up until you've paid $1,000 on your own.

The government pays more than it should for these plans, while the included companies make a larger profit. This game consists of firms paying physicians to report more wellness issues, sharing the additional money with doctors, and also having the medical professional's offices.

4 Easy Facts About Medicare Advantage Agent Explained

Significant health problems can cost many times that. Healthcare insurance coverage aids you obtain the treatment you need and shields you and your family members economically if you get ill or injured. You can obtain it through: Your task or your spouse's work, if the employer uses it. You must meet qualification needs for government health treatment programs. For additional information regarding government programs, browse through Benefits.gov. Find out much more: Medical insurance: 5 things you might not understand See: Are you unexpectedly requiring medical insurance? You can add your household to a job health insurance. If you purchase from an insurance business or the market, you can purchase

a strategy that additionally covers your household. They do not need to live in your home, be signed up in school, or be claimed as a based on your income tax return. You can maintain wedded kids on your plan, yet you can not include their spouses or children to it. If you have reliant grandchildren, you can maintain them on your plan until they transform 25. You can purchase other times only if you shed your insurance coverage or have a life modification. Life changes consist of points like getting married or

separated, having an infant, or adopting a youngster. You resource can authorize up for a job health insurance plan when you're first worked with or have a major life adjustment. They can't deny you coverage or cost you much more as a result of a pre-existing problem or special needs. The cost depends on your circumstances. You'll need to pay premiums and part of the price of your care. A costs is a regular monthly cost you pay to have insurance coverage. To decide your costs, insurance coverage firms will take into consideration: Your age. Whether you smoke or utilize tobacco. Whether the coverage is for a single person or a family. They may rule out your gender or health and wellness factors, including your case history or whether you have a special needs. Costs for specific plans are secured for one year. Rates typically rise when the plan is renewed to show your age and higher healthcare costs. All health and wellness intends require you to.

pay a few of the expense of your healthcare. This is called cost-sharing. Along with premiums, you usually should satisfy an insurance deductible and pay copayments and coinsurance. A is the quantity you need to my company pay prior to your plan will certainly pay. For example, if your insurance deductible is$ 1,000, your strategy will not pay anything until you've paid $1,000 yourself.